in today’s rapidly changing financial landscape, student loan debt has become a defining feature of the collegiate experience, ofen lingering long after the cap and gown have been stowed away. For many graduates, the burden of these loans can feel overwhelming, casting a shadow over their hard-won achievements. Yet, amid the struggle for financial freedom, a beacon of opportunity arises: student loan refinancing. This strategic approach not only promises the potential for important savings but also offers a pathway too greater financial clarity. In this article, we will explore the intricacies of student loan refinancing, unveiling the strategies that can empower borrowers to take control of their debt. Whether you’re seeking lower interest rates,more manageable monthly payments,or a simplified repayment process,mastering the art of refinancing can lead to a brighter,debt-free future. Join us as we navigate the steps and considerations essential for unlocking the savings and possibilities that come with student loan refinancing.

Understanding the Basics of Student Loan Refinancing

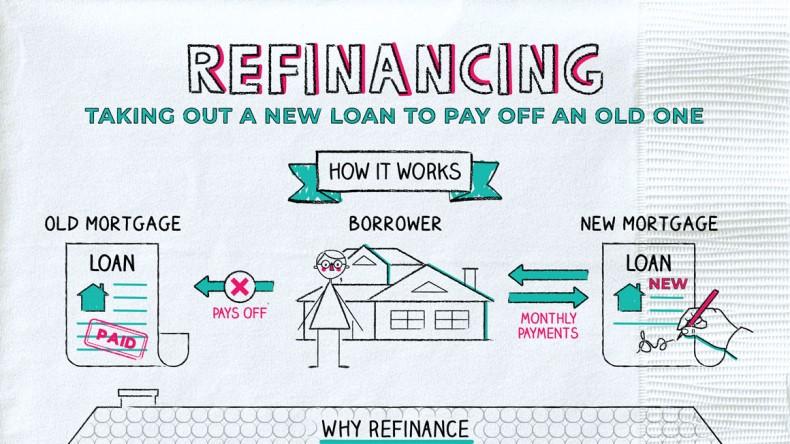

Before diving into the world of student loan refinancing, it’s essential to grasp its fundamental components. Refinancing involves replacing your existing student loans with a new loan, ideally at a lower interest rate, which can lead to significant savings over time. The primary factors that influence your refinancing options include your credit score, income level, and overall financial profile. By understanding these factors, borrowers can make informed decisions that align with their financial goals and create a roadmap to reduced monthly payments.

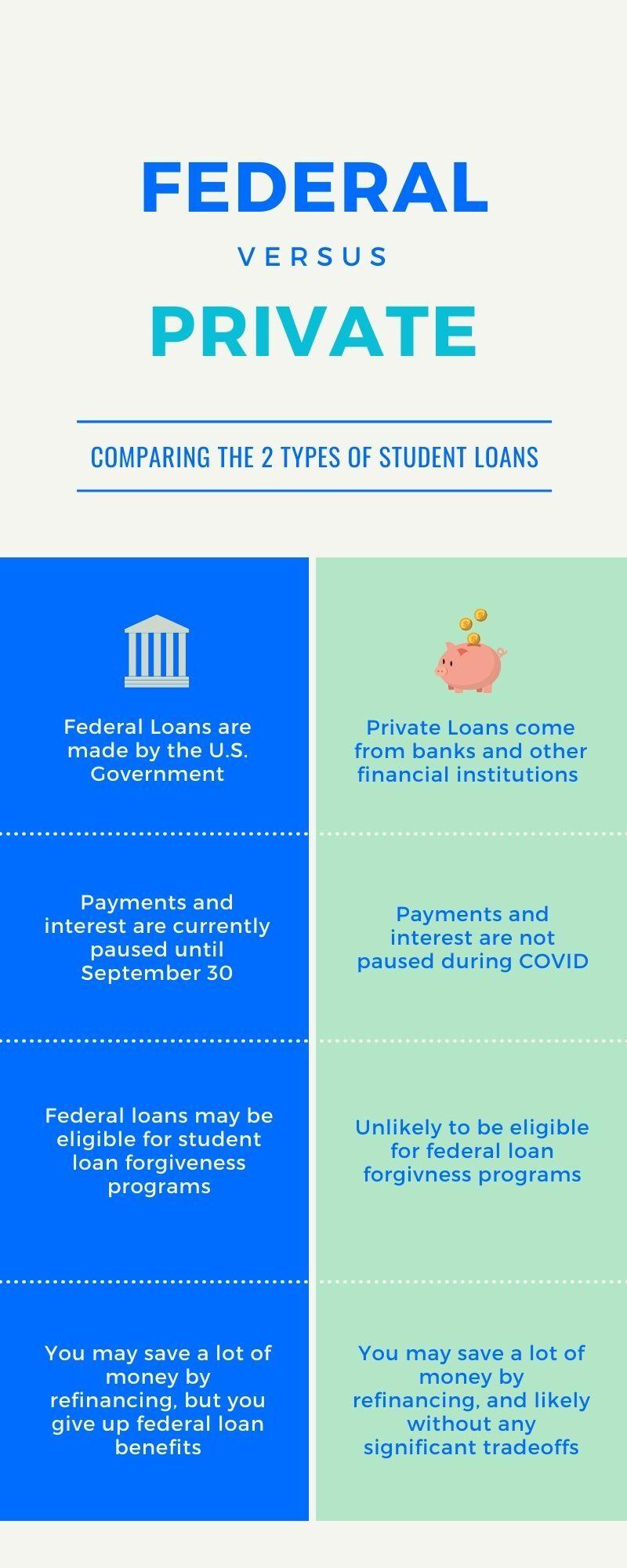

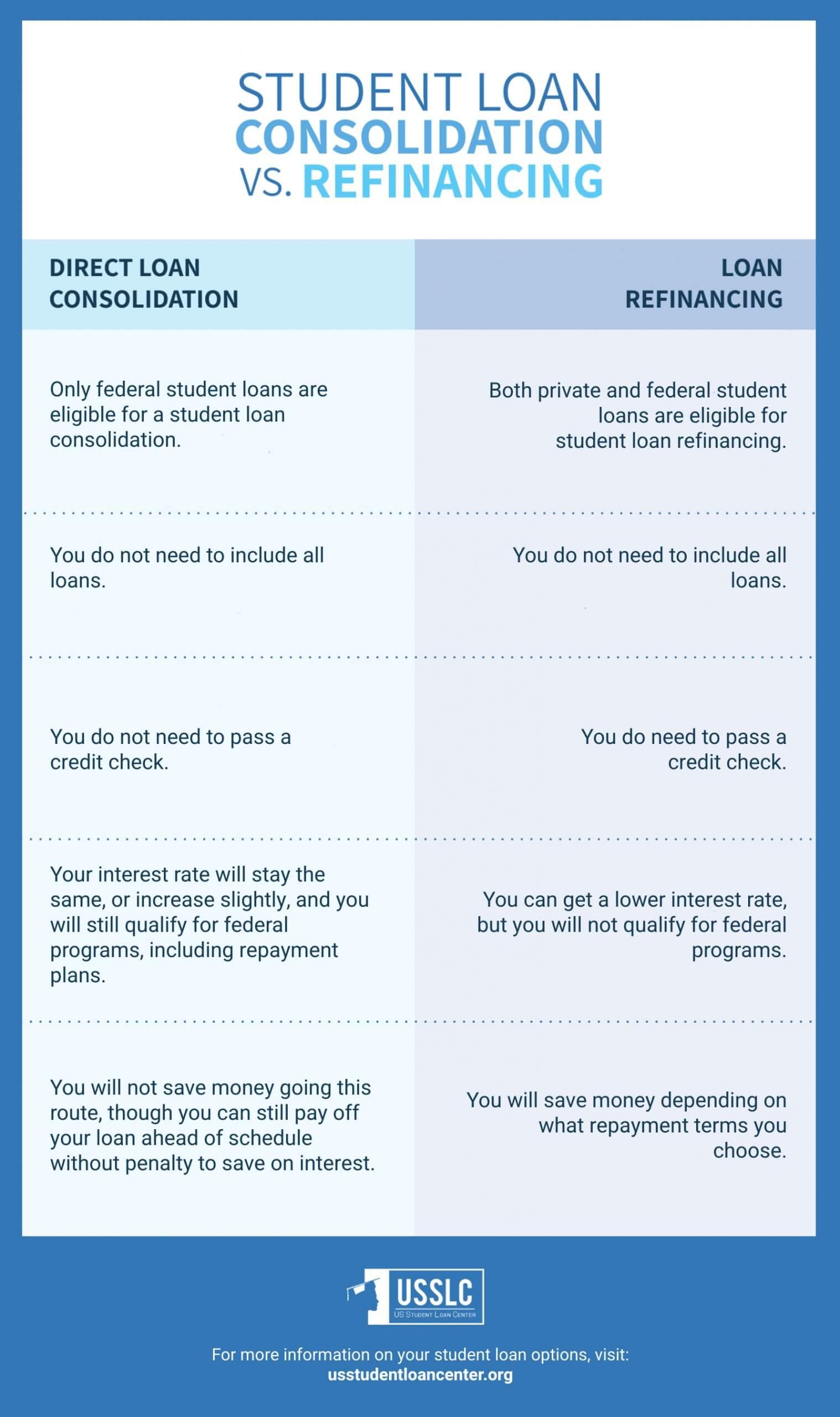

When considering refinancing, it’s crucial to evaluate the potential benefits and drawbacks. the advantages often include lower interest rates, simplified payments, and the opportunity to release a co-signer. However,it is equally crucial to be aware of potential downsides,such as losing federal loan protections and benefits,like income-driven repayment plans and loan forgiveness. To assist in visualizing how refinancing might affect your long-term financial landscape, consider this basic comparison of various loan scenarios:

| Loan Scenario | Interest Rate | Monthly Payment | Total Paid Over 10 Years |

|---|---|---|---|

| Original Loan | 6.8% | $1,150 | $138,000 |

| Refinanced Loan | 4.5% | $1,033 | $123,960 |

In this example, the savings become evident with a refinanced loan that offers a better interest rate, leading to both lower monthly payments and total repayment costs. By closely assessing these aspects, borrowers can navigate the refinancing process with confidence and take meaningful steps toward financial freedom.

Evaluating Your Current loans: Key Considerations for Decision-Making

When navigating the world of student loans, it’s essential to analyze your current financial obligations critically.Start by compiling a complete list of your existing loans, including details such as the lender, interest rate, outstanding balance, and repayment terms. This will give you a clearer view of your overall debt landscape. Additionally, consider the following factors that may influence your refinancing decision:

- interest Rates: Compare your current rates with the potential rates available for refinancing.

- Loan Terms: Evaluate the terms of your loans, considering both the length and flexibility of repayment options.

- Monthly Payments: Assess how refinancing could impact your monthly cash flow and overall budget.

- Credit Score: Check your credit standing,as it plays a crucial role in obtaining lower rates.

- Loan Forgiveness Programs: If applicable, examine whether refinancing will affect your eligibility for any forgiveness programs.

Moreover, calculate the potential savings that refinancing may yield. Utilizing an online loan calculator can provide estimated figures based on various interest rates and loan terms, allowing you to visualize your future payments. To help structure your decision, consider the following comparison:

| Loan Type | Current Rate (%) | Refinanced rate (%) | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|

| Federal Loan | 5.5 | 3.5 | $500 | $3,500 |

| Private Loan | 7.0 | 4.0 | $600 | $5,000 |

By closely examining these elements and utilizing effective tools, you’ll be well on your way to making informed decisions about refinancing your student loans, optimizing your payments and paving the way for significant savings over time.

Choosing the Right Lender: tips for a Competitive Rate

When your ready to refinance your student loans, selecting the right lender can substantially impact the savings you receive. Start by researching multiple lenders and compare their interest rates and terms. Pay attention to the following factors:

- Interest Rates: Fixed vs. variable rates can affect your long-term payment strategy.

- Loan Terms: Review the length of the loan and how it matches your financial goals.

- Fees: Be aware of any hidden fees, such as origination or prepayment penalties.

Understanding these elements will help you narrow down your options effectively.

Additionally, consider checking the lender’s reputation and customer service reviews to ensure you’re making a wise choice. trusted lenders often provide educational resources and support during your refinancing journey. To make the process more obvious, you might even want to create a comparison table to visualize the differences:

| Lender | Interest Rate | Loan Term | Fees |

|---|---|---|---|

| Lender A | 3.50% | 5 years | No Fees |

| Lender B | 4.00% | 10 years | Minimal fees |

| Lender C | 3.75% | 7 years | No Fees |

Crafting a detailed comparison allows you to make informed decisions while saving money on interest over time.

Timing Your Refinancing: When to Take the Plunge

Knowing when to refinance your student loans is crucial for maximizing your financial benefits. Typically, the ideal time to consider refinancing is when you experience a significant positive change in your financial circumstances. Here are some key indicators to watch for:

- Improved Credit Score: A higher credit score can qualify you for better interest rates.

- Stable Income: Consistent,higher income can make you a more attractive borrower.

- Low-Interest Rates: Keep an eye on market trends; refinancing when rates drop can lead to substantial savings.

- Cost of Living Changes: If you move to a lower cost-of-living area, your financial obligations might decrease, freeing up cash for refinancing.

Additionally, it’s critical to evaluate your current loan terms and compare them against what refinancing offers. Use the following table to assess potential savings:

| Current Loan | Refinanced Loan | potential Savings |

|---|---|---|

| Interest Rate: 6.8% | interest Rate: 4.5% | $10,000 over 10 years: $3,000 |

| Interest Rate: 5.5% | Interest Rate: 3.7% | $15,000 over 10 years: $4,500 |

Ultimately, timing your refinancing can significantly impact your long-term savings. be sure to evaluate all aspects—financial status, market conditions, and personal goals—before making the decision to refinance. This strategic approach will help you leverage the benefits effectively and foster a financially healthy future.

calculating potential Savings: A Step-by-step Guide

To begin the process of evaluating potential savings through student loan refinancing, start by gathering all your existing loan details. create a list that includes the current balance, interest rate, and monthly payment for each loan. This foundational facts will serve as the basis for your calculations. Consider the following factors:

- Loan Type: Identify whether your loans are federal or private, as this will influence your refinancing options.

- Interest Rate Comparison: Research and compare rates from various lenders to find the most competitive offers.

- Loan Term: Determine how adjusting the loan term affects your monthly payments and total interest paid.

Once you have compiled your current loan information, it’s time to calculate how refinancing can result in savings. A simple method is to use a refinancing calculator, which can help you visualize potential outcomes based on the new interest rate and loan term. To further illustrate your potential savings, consider setting up a table comparing your existing loans and the refinanced loan:

| Loan Type | Current Interest Rate | Refinanced Rate | Current Monthly Payment | estimated New Payment | Potential Monthly Savings |

|---|---|---|---|---|---|

| Federal Loan | 5.7% | 3.5% | $300 | $180 | $120 |

| Private Loan | 6.2% | 4.0% | $400 | $320 | $80 |

Navigating the Refinancing Process: What to Expect

Embarking on the journey of student loan refinancing can seem daunting, but understanding the steps involved can turn this process into a seamless experience. Initially, it’s crucial to assess your current loans and determine whether refinancing is a beneficial option. This means reviewing your interest rates, monthly payments, and remaining loan balances. Once you have that information, the next step involves researching lenders. Consider factors such as interest rates, repayment terms, customer service reviews, and any associated fees. A well-rounded comparison will help ensure you choose a lender that best fits your financial needs.

As you proceed, prepare to gather necessary documentation, which typically includes proof of income, tax returns, and personal identification. This preparation can streamline the application process significantly. After submitting your information, you might encounter a hard credit check—understanding this could help mitigate any concerns. The final approval hinges on various factors, including your credit score and financial history, so it’s advisable to have realistic expectations.Ultimately, if approved, you will receive the new loan terms, and upon acceptance, your existing loans will be paid off, allowing you to focus on enjoying the benefits of potential savings.

The Conclusion

mastering the art of student loan refinancing is not just about crunching numbers or navigating financial jargon; it’s about unlocking a pathway to greater financial freedom. By understanding your options, evaluating your current loans, and making informed decisions, you can transform your student debt from a burden into a manageable part of your financial landscape. Whether you’re looking to secure a lower interest rate, reduce monthly payments, or shorten your repayment timeline, the key lies in thorough research and personal reflection. As you embark on this journey, remember that the choice to refinance is uniquely yours, one that can lead to significant savings and less stress. With the right approach,you’re well on your way to regaining control over your finances and paving the road to a brighter,debt-free future. So, take a deep breath, assess your situation, and embrace the possibilities that lie ahead—your financial wellness is within reach.