In a world brimming with potential,the quest for financial support often feels like navigating a labyrinth. For entrepreneurs, students, and homeowners alike, the path to achieving their dreams can be obstructed by the daunting challenge of securing funds. Enter government loan programs—a beacon of hope that illuminates the way towards various aspirations, from launching a small business to pursuing higher education or purchasing a home. in this article, we delve into the myriad of these essential programs, exploring how they serve as vital tools for empowerment and advancement, unlocking opportunities that might otherwise remain out of reach. Join us as we uncover the key features, eligibility criteria, and benefits of government-funded initiatives designed to transform aspirations into reality.

Exploring the Landscape of Government Loan programs

Government loan programs are diverse and cater to various needs, providing individuals and businesses with the financial support they require to achieve their goals. Whether you are a budding entrepreneur, a frist-time homebuyer, or a student pursuing higher education, there’s likely a government-backed loan designed specifically for your situation.These programs not only help to alleviate economic disparities but also promote growth and development across various sectors.With favorable terms and conditions, they present an accessible avenue for those who might struggle with conventional financing.

Some of the most prominent loan programs include:

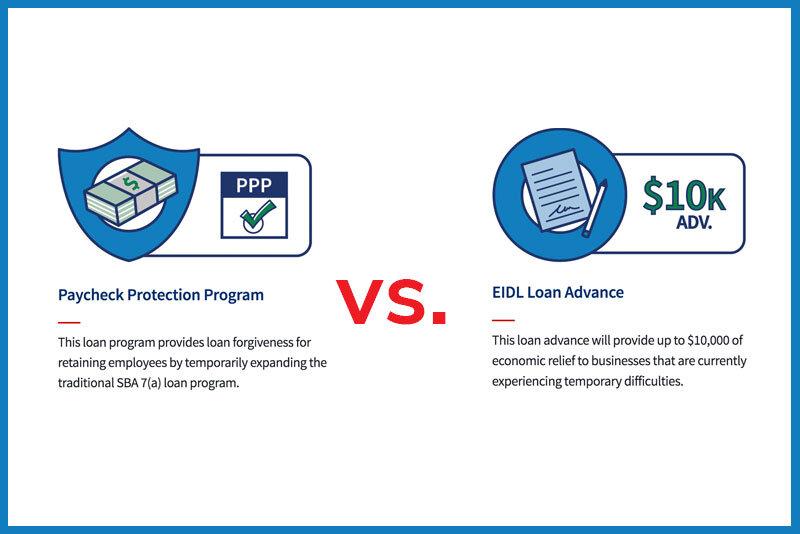

- Small Business Administration (SBA) Loans: Designed to foster small business growth through low-interest loans.

- Federal Housing Administration (FHA) Loans: Aimed at first-time homebuyers to encourage home ownership with lower down payments.

- Direct PLUS Loans: Available for graduate students and parents to cover education costs that exceed other financial aid.

- USDA Rural Development Loans: Perfect for low-income individuals in rural areas, offering no down payment options for eligible properties.

| Loan Program | Target Audience | Key Benefit |

|---|---|---|

| SBA Loans | small Business Owners | Lower interest rates |

| FHA Loans | First-time Homebuyers | Low down payment |

| Direct PLUS Loans | Grad Students & Parents | Covers excess education costs |

| USDA Loans | Rural Homebuyers | No down payment required |

Navigating Eligibility Requirements: What You Need to Know

Understanding eligibility for government loan programs can be daunting, but grasping the basics can open doors to invaluable resources. To qualify for these loans, applicants generally need to meet certain criteria, including:

- Credit Score: A minimum score might potentially be required depending on the program.

- Income Level: Your income must align with established limits for the specific program.

- Purpose of Loan: ensure the loan aligns with qualified uses, such as home buying or educational expenses.

- Citizenship or Residency Status: Typically,applicants must be citizens or permanent residents.

Moreover, the documentation needed to demonstrate eligibility can vary. hear’s a brief overview of common documents you might need to gather:

| Document Type | Description |

|---|---|

| Income Verification | Recent pay stubs or tax returns to prove your income level. |

| identification | Government-issued ID or Social Security number. |

| Credit Report | A recent report to assess your creditworthiness. |

By preparing these documents and understanding your eligibility, you can navigate the landscape of government loan programs more effectively.

Types of Government Loans: A Comprehensive Overview

Government loans come in various forms, each designed to meet specific needs for individuals and businesses. Federal Housing Administration (FHA) loans are aimed at homebuyers with lower credit scores, enabling more people to achieve the dream of homeownership. USDA loans cater specifically to rural areas, promoting development in less populated regions by offering low-interest options for eligible homebuyers. for veterans, VA loans provide a no-down-payment option and favorable terms, making housing more accessible for those who have served in the military. in addition to these, SBA loans support small business owners by offering favorable interest rates and longer repayment terms, thus bolstering entrepreneurship across the nation.

Each loan type has its advantages and requirements, making it essential to understand the options available. Here’s a fast comparison table to illustrate some key features of popular government loan programs:

| Loan Type | Best For | Key Benefit |

|---|---|---|

| FHA Loans | First-time Homebuyers | Low Down Payment |

| USDA Loans | Rural homebuyers | No Down Payment |

| VA loans | Veterans | No Private Mortgage Insurance |

| SBA Loans | Small Business owners | Flexible Loan Terms |

Strategies for Successful Application and Approval

successfully navigating the complexities of government loan applications requires a strategic approach. Start by ensuring you meet the eligibility criteria specified for each loan program. Keep all relevant documents,such as tax returns and financial statements,organized and up-to-date. You should also consider the following key strategies:

- Research Thoroughly: Gain a clear understanding of different loan programs available and identify which ones align with your financial goals.

- Craft a Strong Business Plan: If applying for a business loan, a solid plan showcasing your vision and financial projections can substantially strengthen your application.

- Prepare a Personal Statement: This should reflect your motivations and qualifications, providing a comprehensive picture of your character and commitment.

once you have prepared your application, ensure it is meticulously reviewed to eliminate any errors or inconsistencies that could jeopardize your approval chances. Additionally, maintaining open lines of communication with lenders can be beneficial. Here are some steps to enhance your application’s approval potential:

| Action | Benefit |

|---|---|

| Provide Complete Documentation | Speeds up the review process and reduces chances of delays |

| Showcase Creditworthiness | Improves your standing in the eyes of lenders |

| Use Clear, Concise Language | Makes your application easy to read and understand |

Maximizing Benefits: Tips for Loan Management and Repayment

Effectively managing and repaying your loans is crucial for financial health and can open doors to future opportunities. to get the most out of your loan, consider the following strategies:

- Create a Budget: Outline your income and expenses to ensure timely payments.

- Prioritize High-Interest Loans: Focus on paying off loans with higher interest rates first to minimize overall costs.

- Utilize Loan Forgiveness Options: Research programs that may forgive a portion of your loan based on your career, repayment history, or financial hardship.

- Avoid Default: Communicate with your lender if you’re struggling; they may offer deferment or modified payment plans.

- Regularly Review Your Loan Terms: stay informed about interest rates, fees, and repayment schedules.

Additionally, consolidating loans can simplify repayment and possibly reduce interest rates. Consider the following benefits:

| Benefit | Description |

|---|---|

| Single Payment | Combine multiple loans into one easy-to-manage payment. |

| Lower Interest Rate | May secure a lower rate compared to your existing loans. |

| Improved Credit Score | consistent payments can enhance your credit profile over time. |

Success Stories: real-Life Impacts of Government Loans on Individuals and Communities

Key Takeaways

In closing, the landscape of government loan programs serves as a dynamic pathway to potential growth and innovation. Whether you’re an aspiring entrepreneur, a budding student, or a homeowner ready to invest in your future, understanding and leveraging these opportunities can unlock doors that may have once seemed closed. By navigating this intricate system with preparation and knowledge, individuals can transform aspirations into reality, bridging the gap between dreams and achievement. As we look ahead, let us recognize that the key to success lies not only in the programs available but in our ability to harness them effectively. So,take a deep breath,explore the options,and embark on your journey of financial empowerment—as the opportunities waiting for you are just a loan away.