In the labyrinth of entrepreneurship, where ideas flicker like candle flames and aspirations rise like hot air balloons, one element often serves as the rudder steering the ship toward success: financing. Navigating the world of business loans can feel daunting—an intricate dance among lenders, credit ratings, and ever-changing market conditions. Yet,for those equipped with the right tools and knowledge,this journey transforms into an empowering expedition. “Mastering Business Loans: Essential Tools and Tips for Success” invites you to explore the vital strategies and insights you need to harness the power of business financing. Weather you’re a seasoned entrepreneur or a budding innovator, this guide will illuminate the path to securing the capital that can elevate your venture to new heights.Prepare to embark on an enlightening exploration that breaks down the barriers to financial fluency and equips you for the challenges ahead.

Understanding the Varied Landscape of Business Loans

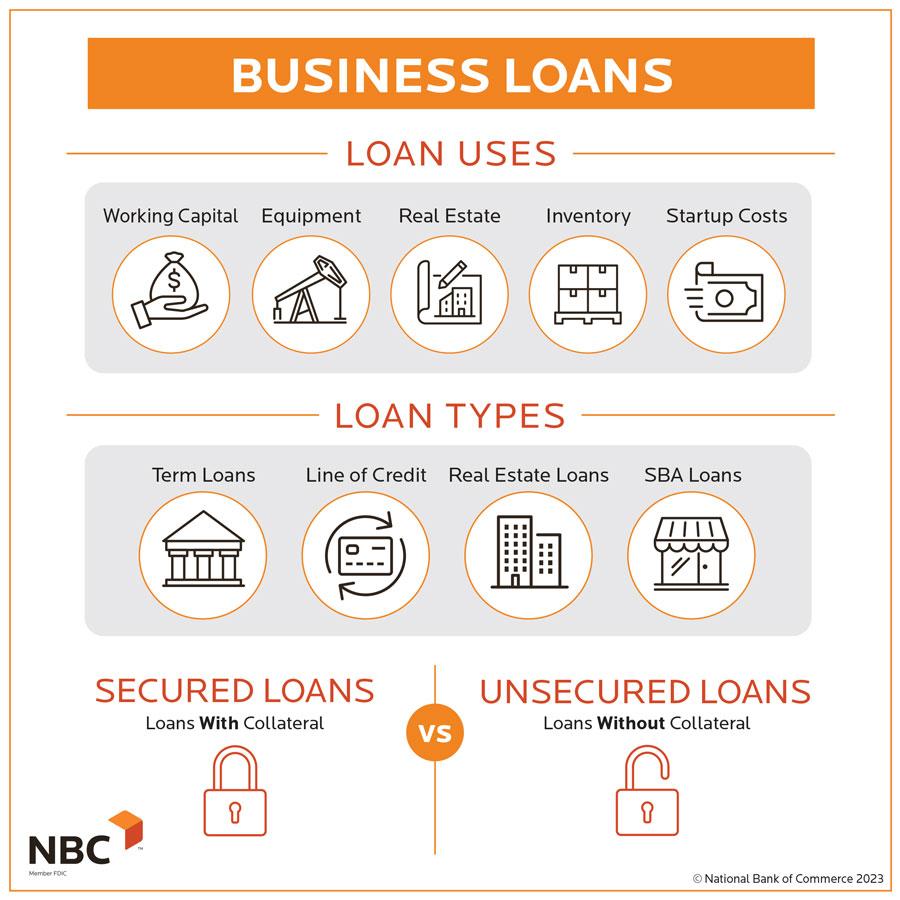

The landscape of business loans is incredibly diverse, reflecting the unique needs and circumstances of various enterprises. Entrepreneurs must navigate through a plethora of options, each designed to cater to specific financial requirements. Key types of business loans include:

- Term Loans: Traditional loans for long-term funding, repaid in installments.

- Lines of Credit: Flexible funding that allows for borrowing as needed.

- Short-Term Loans: Quick access to capital, typically with a higher interest rate.

- SBA Loans: Government-backed loans that offer favorable terms for small businesses.

- Invoice Financing: Collateralizing unpaid invoices to secure immediate cash flow.

Understanding these different products is vital for business owners looking to finance their ventures. Each type of loan comes with its own set of qualifications, interest rates, and repayment structures, which can significantly influence a company’s financial health. To make well-informed decisions, consider the following factors:

- Interest Rates: Compare the costs associated with different types of loans.

- Repayment Terms: Assess how repayment schedules align with your cash flow.

- Qualification Requirements: Analyze your business’s creditworthiness and financial status.

- Purpose of the Loan: Clearly define how the funds will be utilized to ensure optimal loan selection.

Key Factors to Consider when Choosing the Right Loan

When evaluating loans for your business, it’s crucial to look beyond just the interest rates. Consider the loan terms, which dictate the duration of repayment and the overall financial strategy you plan to implement.A longer loan term may result in smaller monthly payments, but often comes with higher total interest costs. Conversely, shorter terms can save on interest but require larger monthly payments, which may strain cash flow. Also, assess the flexibility of the loan, including options for early repayment without penalties and the ability to adjust terms based on business growth or changes in financial circumstances.

Another fundamental aspect is the lender’s reputation and the quality of customer service. research potential lenders to gauge their reliability and support throughout the loan process. Review borrower testimonials and feedback to understand their experiences. Additionally,consider the collateral requirements: some loans may necessitate personal or business assets as guarantees. Understanding which assets you’re willing to put at risk is vital.lastly, evaluate any additional fees associated with the loan, such as origination fees, processing fees, or prepayment penalties, as these can significantly impact the overall cost of borrowing.

Navigating the Application Process with Confidence

Approaching the business loan application process can feel daunting, but with the right tools in your arsenal, you can maneuver through it with ease and assurance. First, gather your essential documents, which typically include:

- Business Plan: A well-structured plan outlines your goals, strategies, and financial forecasts.

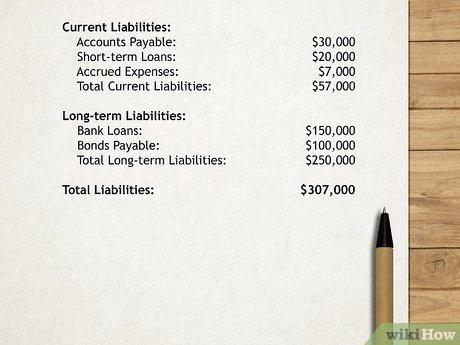

- Financial Statements: Recent income statements, cash flow statements, and balance sheets provide lenders insight into your performance.

- Tax Returns: Personal and business tax returns help verify your financial history.

- credit Report: Reviewing your credit history allows you to understand your standing and address any issues prior to applying.

Next, create a detailed application that showcases your business’s strengths and aligns with lender requirements. Familiarize yourself with various loan types and their specific criteria to ensure you’re targeting the right sources. Consider preparing a comparison table to analyze potential loan options based on:

| Loan Type | Interest Rates | Repayment Terms | Eligibility Requirements |

|---|---|---|---|

| Traditional Bank Loan | 4-7% | 1-10 years | Strong credit, collateral required |

| SBA Loan | 6-10% | 5-25 years | must meet SBA qualifications |

| Online Lender | 7-20% | 6-36 months | No collateral; lenient credit requirements |

By thoughtfully preparing and understanding your options, you can approach lenders with the confidence that comes from being well-informed, enhancing your chances of securing the funding necessary for your business’s growth.

Building a Strong Financial Profile for Loan Approval

Creating a robust financial profile is crucial for enhancing your chances of securing a loan. Lenders assess multiple factors to gauge your credibility and risk level, and by paying attention to these areas, you can significantly improve your appeal. Start by ensuring your credit score is in good standing, as this number serves as a quick snapshot of your financial responsibility. Aim for a score of 700 or above, as it often qualifies you for better loan terms. Furthermore, maintaining a healthy debt-to-income ratio — ideally below 36% — demonstrates your ability to manage repayments effectively. Don’t forget to keep detailed records of your business income and expenses; having organized financial statements can make a significant difference during the approval process.

Another vital component of your financial profile is showcasing your business history and stability. Lenders prefer to see a track record of consistent revenue growth, so articulate how your business has evolved. Share compelling data, including your annual revenue and any increases over the past few years. Consider presenting this information visually to make it more digestible for lenders. For example, a simple table can highlight your revenue trends:

| Year | Annual Revenue | Growth Percentage |

|---|---|---|

| 2021 | $100,000 | – |

| 2022 | $120,000 | 20% |

| 2023 | $150,000 | 25% |

by demonstrating solid financial practices and past growth, you not only support your loan application but also instill confidence in lenders regarding your future performance.

Utilizing Debt Responsibly to Fuel Growth and Innovation

Leveraging debt as a strategic tool can propel businesses toward growth and innovation, provided that it is handled with care and foresight. Responsible borrowing enhances cash flow, allowing for investment in new technologies, product development, or market expansion. To ensure that debt is a boon rather than a burden,entrepreneurs should consider the following strategies:

- Define Clear Objectives: Establish specific goals for how borrowed funds will be used,ensuring they align with long-term business strategies.

- Assess Debt Capacity: Analyze current financial health and determine how much debt can be comfortably managed without jeopardizing operations.

- choose the right Type of Financing: Explore various loan options—such as term loans, lines of credit, or SBA loans—to find the most suitable fits for your needs.

- monitor Cash Flow: regularly review incoming and outgoing funds to maintain a healthy balance and meet repayment obligations.

To optimize the benefits of borrowed funds, it is essential to implement a robust framework for tracking their impact on growth. This can be achieved through regular performance evaluations and by setting tangible metrics, which may include:

| Metric | Description |

|---|---|

| Return on Investment (ROI) | measure the profitability gained from the innovative projects funded by debt. |

| Customer Acquisition Cost | Evaluate the costs associated with gaining new customers post-investment. |

| Market Share Growth | Analyze improvements in market position following expansion efforts financed by loans. |

By establishing this framework and adhering to responsible borrowing practices, businesses can unlock new avenues for growth while ensuring their financial stability remains intact.

Best Practices for Managing Loan Repayment and Financial Sustainability

Effectively managing loan repayment is crucial for maintaining financial sustainability within your business. One of the best practices is to develop a thorough cash flow forecast, allowing you to visualize income and expenses over the coming months. This projection will enable you to allocate funds appropriately, ensuring that loan payments are made on time and without straining other operational costs.additionally, setting up automatic payments can help prevent late fees and maintain a strong credit score. Regularly reviewing your financial statements is also essential to identify trends and make necessary adjustments to your repayment strategy.

Another key practise involves establishing a dedicated loan repayment fund. By creating a seperate account for loan repayments, you can avoid the temptation to use those funds for other expenses. Allocate a fixed percentage of your monthly revenue to this account to ensure that you remain on track with your payment obligations. It’s also helpful to engage in regular communication with your lender. Discussing your financial situation openly can provide opportunities for restructuring payments, extending loan terms, or other forms of relief if needed. Below is a simple table highlighting these practices:

| Practice | Benefit |

|---|---|

| Cash Flow forecast | Visualize finances; allocate funds securely |

| Automatic Payments | Avoid late fees; improve credit score |

| Dedicated Repayment Fund | Protects funds; ensures timely payments |

| Open Communication with Lender | Opportunities for assistance and flexibility |

The Conclusion

navigating the landscape of business loans may seem daunting, but with the right tools and knowledge at your fingertips, success is well within reach. By understanding the ins and outs of different financing options, assessing your unique needs, and employing strategic planning, you can make informed decisions that align with your business goals. Remember, the journey might be intricate, but it is also an prospect for growth and innovation. Embrace the challenge, equip yourself with the insights shared in this guide, and step confidently into the financing arena. With diligence and planning, you will not only master the art of securing business loans but also foster a thriving enterprise that stands the test of time. The future of your business awaits—let’s seize it together!