As the weight of student loans settles on the shoulders of millions, the path to financial freedom can feel like a daunting labyrinth. For those seeking a manageable way to navigate their repayment journey,income-driven repayment plans (IDR) stand as a beacon of hope. These plans offer tailored solutions, adjusting monthly payments according to an individual’s financial circumstances, thus providing a lifeline for borrowers striving to balance their financial commitments. In this article, we will explore the world of income-driven repayment plans, unraveling their intricacies and highlighting key benefits, eligibility criteria, and practical tips that can empower borrowers to make informed decisions. Join us as we demystify this essential aspect of student loan management, paving the way for a brighter financial future.

Understanding income-Driven Repayment Plans and Their Importance

Income-driven repayment plans (IDR) have emerged as a critical solution for borrowers navigating the often overwhelming landscape of student loan debt. These plans adjust monthly payment amounts based on a borrower’s income and family size, making them a vital resource for those who may be struggling to meet standard repayment obligations. By capping payments at a percentage of discretionary income, these plans not only provide financial relief but also help prevent loan defaults, enabling borrowers to maintain more manageable lifestyles while pursuing their career goals. Key benefits include:

- Flexible Payments: Payments can reduce significantly as income changes.

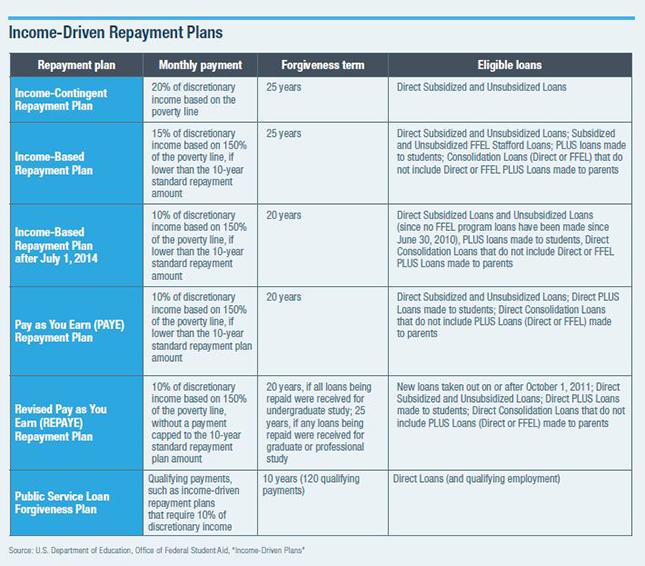

- Loan Forgiveness: Remaining balances may be forgiven after 20 to 25 years of qualifying payments.

- Family Considerations: Plans consider borrower’s family size to adjust payments appropriately.

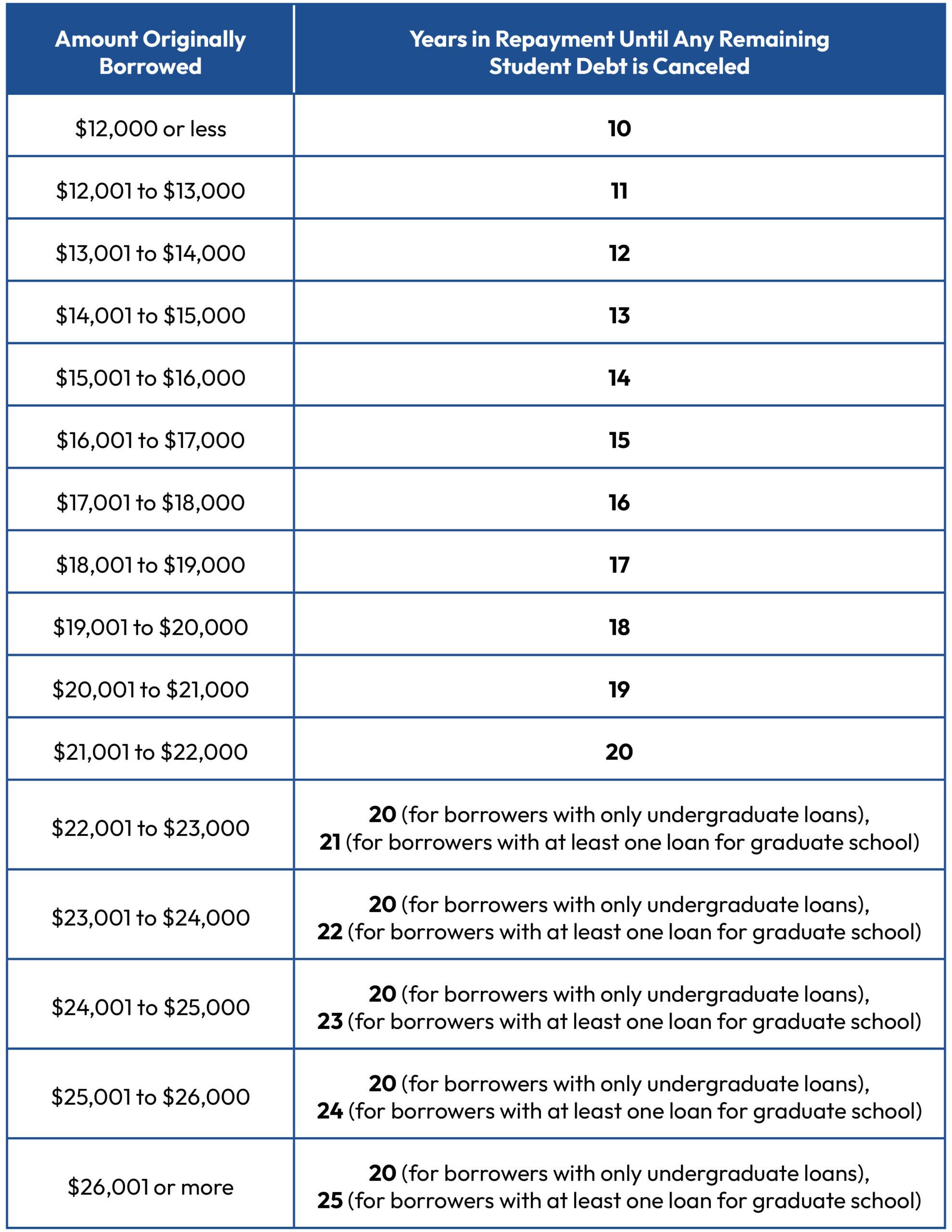

understanding these plans is crucial, especially as they can vary significantly by the borrower’s federal student loan type and the specifics of each plan. Popular options include Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), each with unique eligibility criteria and repayment calculations.It’s essential for borrowers to explore all available routes, weighing the long-term implications on both debt and financial goals. Consider the following table to compare some of the key features of these plans:

| Repayment plan | Payment Percentage | Forgiveness Timeline |

|---|---|---|

| IBR | 10%-15% of discretionary income | 20-25 years |

| PAYE | 10% of discretionary income | 20 years |

| REPAYE | 10% of discretionary income | 20 years (undergraduate loans), 25 years (graduate loans) |

Evaluating Your Eligibility for Income-Driven Repayment Options

Understanding whether you qualify for income-driven repayment plans can significantly impact your financial wellbeing. To evaluate your eligibility, begin by assessing your income against the federal poverty guideline for your household size.Be sure to consider factors such as:

- Your current income: Use your latest pay stubs or tax returns to gauge what you earn.

- household size: Include all members who depend on your income, such as children or other relatives.

- Loan type: Ensure your loans are federal student loans,as most income-driven repayment plans apply only to these.

Your next step is to apply for an income-driven repayment plan through your loan servicer. Many borrowers find it beneficial to complete the application online for a quicker response. During this process, you will need to provide documentation proving your income, which may include:

| Document Type | Description |

|---|---|

| Recent Pay Stubs | Submit your last paycheck stubs for a snapshot of your earning. |

| Tax Returns | Include your recent tax return if your income has fluctuated. |

| W-2 Forms | These confirm your employment and income for the year. |

Breaking Down the Different Types of income-Driven Plans

When it comes to managing student loan repayments, understanding the available income-driven plans can make all the difference in alleviating financial pressure. Each plan has unique features designed to accommodate various financial situations. The major options include:

- Income-Based Repayment (IBR): Ideal for borrowers with a partial financial hardship, this plan caps monthly payments at 10-15% of discretionary income, with forgiveness after 20-25 years.

- Pay As You Earn (PAYE): Similar to IBR, this plan sets payments at 10% of discretionary income and offers forgiveness after 20 years, but is available only to new borrowers after October 1, 2007.

- Revised Pay As You Earn (REPAYE): This option extends the repayment term to 20 years for undergraduate loans and 25 for graduate loans, with payments also capped at 10% of discretionary income.

- Income-Contingent Repayment (ICR): This plan allows for payments based on your income and family size, with the potential for forgiveness after 25 years.

To help clarify each plan’s structure, here’s a simple comparison of their key attributes:

| Plan Type | Payment Calculation | Forgiveness Period |

|---|---|---|

| IBR | 10-15% of discretionary income | 20-25 years |

| PAYE | 10% of discretionary income | 20 years |

| REPAYE | 10% of discretionary income | 20-25 years |

| ICR | Income-based calculation | 25 years |

Calculating Your Monthly Payments: A Step-by-Step Guide

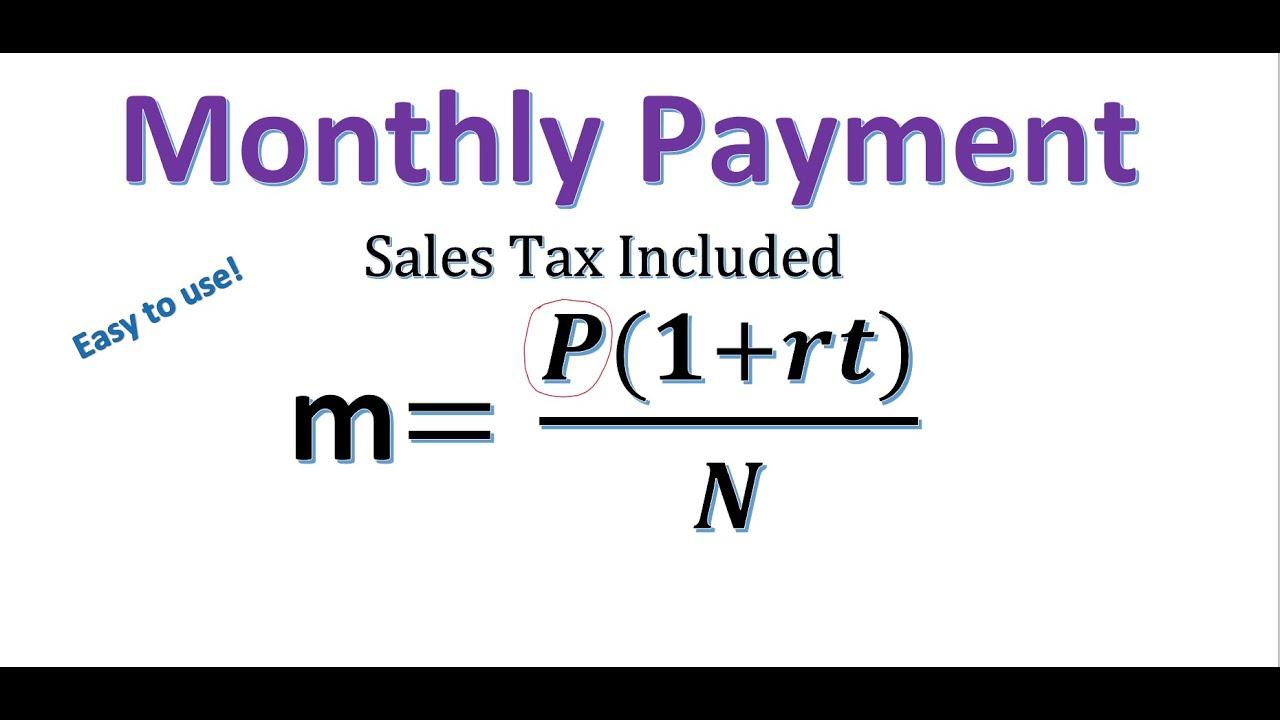

Understanding how to calculate your monthly payments can make all the difference when navigating income-driven repayment plans for student loans.The goal is to ensure that your payments are manageable based on your income and family size. Follow these steps to get started:

- Gather your financial information: Collect documentation of your income,including pay stubs and tax returns,as well as details on your household size.

- Determine your discretionary income: This is the portion of your income that the repayment plan will use to calculate your payment amount, generally defined as your annual income minus 150% of the poverty guideline for your family size.

- Choose the right plan: Research the various income-driven repayment plans, such as REPAYE, PAYE, or IBR, to determine which best suits your financial situation.

- Utilize online calculators: Many loan servicers provide online tools to estimate your payment based on your income and circumstances.

Once you’ve gathered your information, you can jump into the calculation of your monthly payment. Here’s a simplified breakdown:

| Income-Driven Plan | Payment Calculation | Example Payment (based on $40k income) |

|---|---|---|

| REPAYE | 10% of discretionary income | $250 |

| PAYE | 10% of discretionary income | $250 |

| IBR | 15% of discretionary income | $375 |

By determining which income-driven repayment plan works for you, calculating these payments can become a straightforward process, allowing you to maintain financial stability while managing your student loan debt effectively.

Strategies for Maximizing Benefits from income-Driven Repayment

To truly benefit from income-driven repayment plans, start by regularly assessing your income and family size. This ensures your payment amounts are reflective of your current financial situation, which can change frequently. Review your income documentation annually, and consider how fluctuations, such as job changes or increases in salary, affect your repayment calculations. Also, update your family size whenever necessary; this can significantly reduce your monthly payment and, later, the overall loan burden.

Another key strategy is to explore loan forgiveness options that coincide with your repayment plan. enrolling in a qualifying repayment plan can lead to forgiveness after a set period, typically 20 to 25 years. It’s crucial to keep detailed records of your payments for verification purposes. Additionally, you may want to prioritize payments towards loans that do not qualify for forgiveness; doing so may accelerate your overall repayment timeline.Maintain good dialogue with your loan servicer and regularly check for any changes to your repayment options or eligibility criteria.

Common Pitfalls and How to Avoid Them on Your Journey to Financial Freedom

Many individuals embarking on the path to financial freedom overlook critical details in their income-driven repayment plans for student loans,leading to missed opportunities and unnecessary stress. One common pitfall is underestimating the importance of income documentation. Ensuring that you regularly submit accurate income verification is vital, as failing to do so can result in your payments reverting to the higher standard rate, which can substantially impact your financial plan. Additionally, awareness of the plan types is crucial; choosing the wrong plan for your financial situation may lead to inadequate payment amounts or extended payoff timelines that could hinder your overall financial goals.

Another frequent mistake is neglecting to recalculate your necessary payment each year or whenever your financial situation changes. It’s essential to understand that your payment amounts in income-driven plans are not fixed; thus, if you experience a pay increase or a change in household income, you should promptly update your repayment plan to reflect your new circumstances. There are also various repayment options available, and understanding their implications can help you avoid the trap of accumulating unnecessary interest or extending your loan period.To assist in navigating these choices, consider the following table that summarizes key features of popular income-driven plans:

| Plan Name | Payment Calculation | Loan Forgiveness |

|---|---|---|

| Income-Based Repayment (IBR) | 15% of discretionary income | After 20-25 years |

| Pay As You Earn (PAYE) | 10% of discretionary income | After 20 years |

| Revised Pay As You Earn (REPAYE) | 10% of discretionary income | After 20-25 years |

future Outlook

navigating the labyrinth of income-driven repayment plans for student loans may seem daunting, but it can also be empowering. These plans are designed to offer you financial flexibility, allowing you to manage your repayments in a way that aligns with your unique financial journey. As you take the reins of your student loan adventure, remember that understanding your options, staying informed, and seeking guidance when needed can make all the difference. Whether you’re just starting out or well into your repayment plan, know that you are not alone in this process. With the right knowledge and tools, you can chart a course towards a brighter financial future, one step at a time. Embrace the journey ahead, and may your efforts lead you to success and peace of mind.